When it comes to taxes, not every state is equal, and knowing which states are retirement tax-friendly can save you money and future headaches. You can determine the most tax-friendly states for retirees by looking at property tax, income tax and sales tax. It’s also important to understand how Social Security benefits are taxed as well as pensions and retirement accounts.

Living well in your retirement is largely contingent on where you choose to live. To construct this list we compiled information reported on all 50 states. While taxes vary widely among states in the above categories, the following six states consistently ranked the highest in these areas.

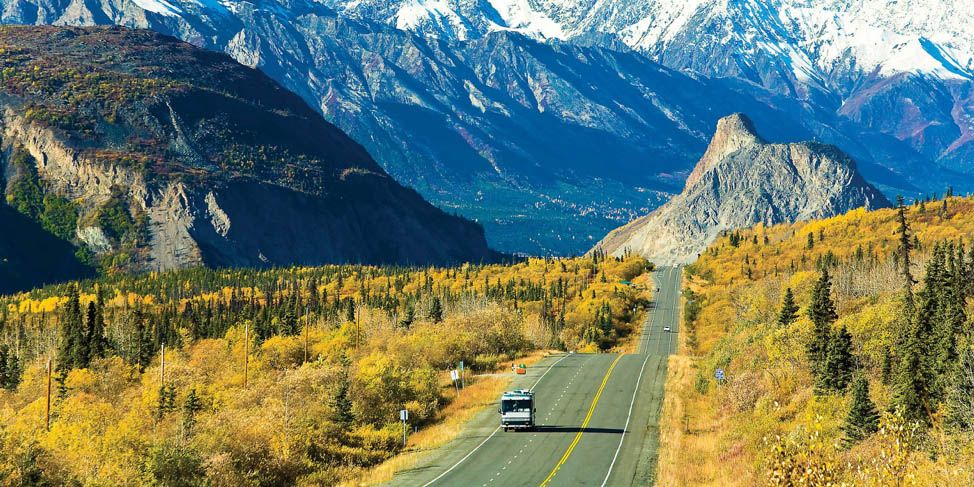

Alaska

For those who enjoy the great outdoors and don’t mind sitting by the fireplace year-round, Alaska is a fantastic place to retire and shed the hefty tax burdens found across the nation. Alaska boasts zero income tax and no estate tax.Since retirees don’t have to pay income taxes, you will receive the full amount of your Social Security benefits, in addition to your retirement or investment accounts.

To make things even better, there’s no sales tax in Alaska either. If you live or shop in Fairbanks or Anchorage, you won’t be subject to local sales tax. Once you’ve retired in Alaska for over a year you’ll receive a dividend check from the state every year. This is largely in thanks to Alaska’s prosperous oil wealth savings account.

Wyoming

Nestled in the Heartland of America, Wyoming is a beautiful tax-friendly state that attracts both retirees and average citizens alike. Another state rich in oil and mineral resources, Wyoming is able to lower the tax burden of its residents due to its own revenues from natural resources. Retired couples and individuals pay no income tax and benefit from some of the lowest sales tax rates.

Wondering about your property taxes? You’ll find quite a relief in this area, too. Wyoming lands in the top 10 when it comes to America’s lowest property taxes. If that doesn’t excite you, some seniors may be eligible for a refund of nearly $1,000 on their utilities, property taxes, and sales/use taxes.

South Dakota

When you think of South Dakota you probably think about Mount Rushmore — not retirement, but looking at the numbers you’ll understand why so many retirees choose to settle down in the state. The main attractions? No income tax, no estate tax, and a cool 5.84% sales tax. The perfect recipe for a retirement where your Social Security is untaxed and the local government isn’t climbing into your wallet.

You’ll benefit from the 3rd lowest tax burden in the US, and although there might be cheaper states to live in by expenses, South Dakota is only a percent higher in living costs than the nation’s average. And South Dakota is home to one of the best midsize cities, Sioux Falls.

New Hampshire

New Hampshire, a beautiful and quaint state, is one of the most serene in the United States. Known as being one of the least populous states in the nation, retirees enjoy peace and quiet and lots of money back in their pockets. New Hampshire retirees enjoy no income tax, no state tax, no sales tax and no inheritance tax. This is one of the few places you’ll find where Uncle Sam doesn’t ask for his fair share, so your retirement, Social Security and recent trip to the store won’t be burdened by heavy tax obligations.

Are you a fan of exemptions? There are added benefits to moving to New Hampshire early. Retirees ages 60 and over who have lived in The Granite State for at least five years will receive an exemption from their property taxes, which is a plus considering it’s not the cheapest state to live in. You can receive an additional exemption for taxes on dividend interest.

Nevada

This state is known for being home to Las Vegas and a stranger to rain, but it’s also the perfect state to eliminate taxes from your life — income taxes, that is. The 8th lowest state in terms of tax burden, Nevada won’t take its share out of your income and benefits. If you’re interested in trying your luck at the casino, your winnings are safe with you: Nevada doesn’t tax estates or inheritance.

While retirees won’t find the cost of living to be the most desirable (in fact it’s one of the most expensive states in the US), you do have tons of exciting places to visit and entertainment to enjoy. Nevada also house a wide range of communities for those 55 and over, making it an excellent state to settle down.

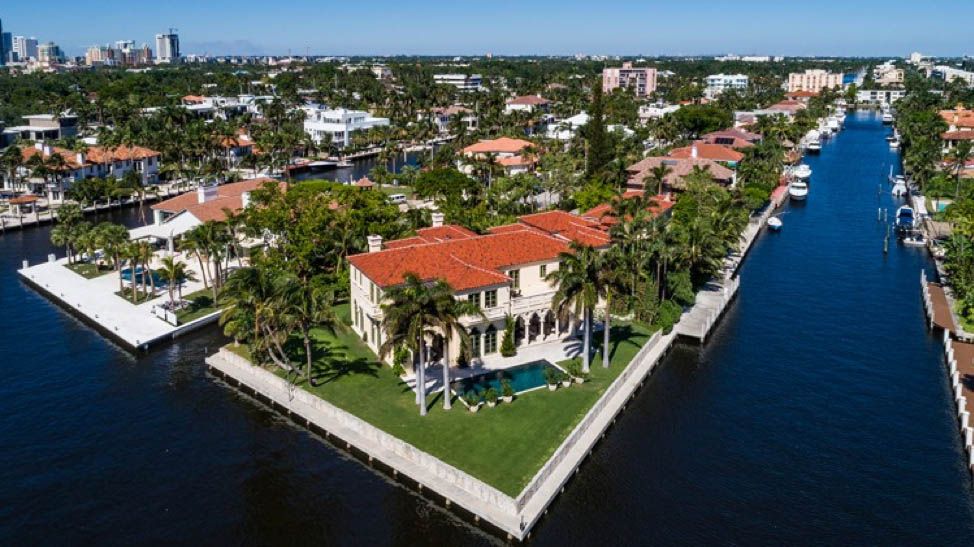

Florida

Florida, everyone’s favorite state to visit has long been a destination for retirees to enjoy the sun and benefit from tax breaks after years of hard work. While it doesn’t always top the list of tax-friendly states, it’s absence of state income tax and estate tax paired with low property tax makes it a winner every time.

Retirees won’t see much of a break when it comes to sales tax, although some cities can be slightly generous in this area depending on which part of the state you reside in. In some counties, retirees within certain income limits can claim a homestead exemption up to $50,000 once you reach the age of 65.

Where to Retire?

Although these are the most tax-friendly states to live in during retirement, any state that boasts zero income tax and little to no sales tax is worth considering. Look out for state that will tx your Social Security benefits and cut into an already fixed income. Take into account your quality of life in each state and the kind of housing you can afford. Retirement affords you an opportunity to enjoy life and participate in a range of activities. Having more money in your pocket to do so is essential to living your life to its fullest. To learn more about tax rates for each state, check out the tax map by Kiplinger for in-depth comparisons.